We help our home seller client’s obtain bank-approved short sales in the Chicago area.

A short sale will allow a Chicago homeowner to sell a home for less than what is currently owed on the mortgage. Since the bank owns the title of the home until the mortgage is paid in full, the bank must approve the sale price of the home before it can be sold for less than what is currently owed on the mortgage, hence the name “short sale”.

What is a Short Sale?

A short sale is an excellent solution for a homeowner that needs to sell a property due to financial hardship. Banks and the government will do anything they can to avoid a foreclosure. Short sales are much more difficult to execute and there are many more steps to selling a home via short sale. That is why it is important to work with a Chicago real estate agent that is experienced in short sales.

Banks typically look for 3 things before they will approve a short sale:

Verifiable Financial Hardship

Monthly Cash Flow Shortfall or Pending Cash Flow Shortfall

Insolvency

If these three criteria are met and you know that you will be in a position where you won’t be able to pay your mortgage in the near future, it is vital to act now and get your property listed with a Chicago short sale expert before the foreclosure process has begun. If you wait too long, it will severely limit your chances of the short sale for your home being successful.

Why Home Buyers and Investors Love Short Sales:

Many home buyers seek out short sales and foreclosures exclusively because they believe that is the only way that they will be able to get a “good deal”. In addition to a regular home buyer that is purchasing a home to live in, international buyers and real estate investors are always looking for good opportunities to invest in Chicago real estate.

Selling a Short Sale Home in Chicago

If you list your home for sale with an experienced short sale realtor in Chicago, chances are good that you will get an offer for your property and you will be well on your way of relieving any financial burden that the home may have on you.

Connect with Chicago Short Sale Experts Today!

Top Short Sale Real Estate Agents

Michael Samm and Mark Quesada

312-767-7504

As experienced short sale real estate agents, we have the knowledge, tools and marketing platforms to get your home approved for a short sale by your bank and sold to a buyer before a foreclosure sets in.

Protect your credit score and contact experienced short sale realtors in Chicago today!

The West Town Team | Short Sale Agents

312-767-7504

Read our client reviews on Zillow.

Myth: Short Sales are Embarrassing

During the last economic downturn in the United States, 1 out of 5 homeowners were in a short sale situation and approximately 40 - 60% of home sales in the United States were short sales. If you are reading this, congratulations on taking the first step to admitting you need help with a short sale. The next step is to contact a short sale professional in Chicago that will help you work towards a solution.

It is not in the best interest of the banks to foreclose on homes in their portfolio. They would much rather sell the home via short sale.

The banks will require that the homeowner prove financial hardship, monthly income shortfall and insolvency (or proof that you don’t have significant liquid assets that would allow you to pay down your mortgage).

Negotiating a Short Sale Before a Foreclosure

A bank can stall a foreclosure right up until the final day in the foreclosure process. Typically all that is needed is a phone call from the seller and/or designated seller’s agent letting the bank know that you are trying to sell your home. Especially, if you already have a contract from a legitimate ready, willing and able buyer.

7 Most Important Strategies to a Successful Short Sale

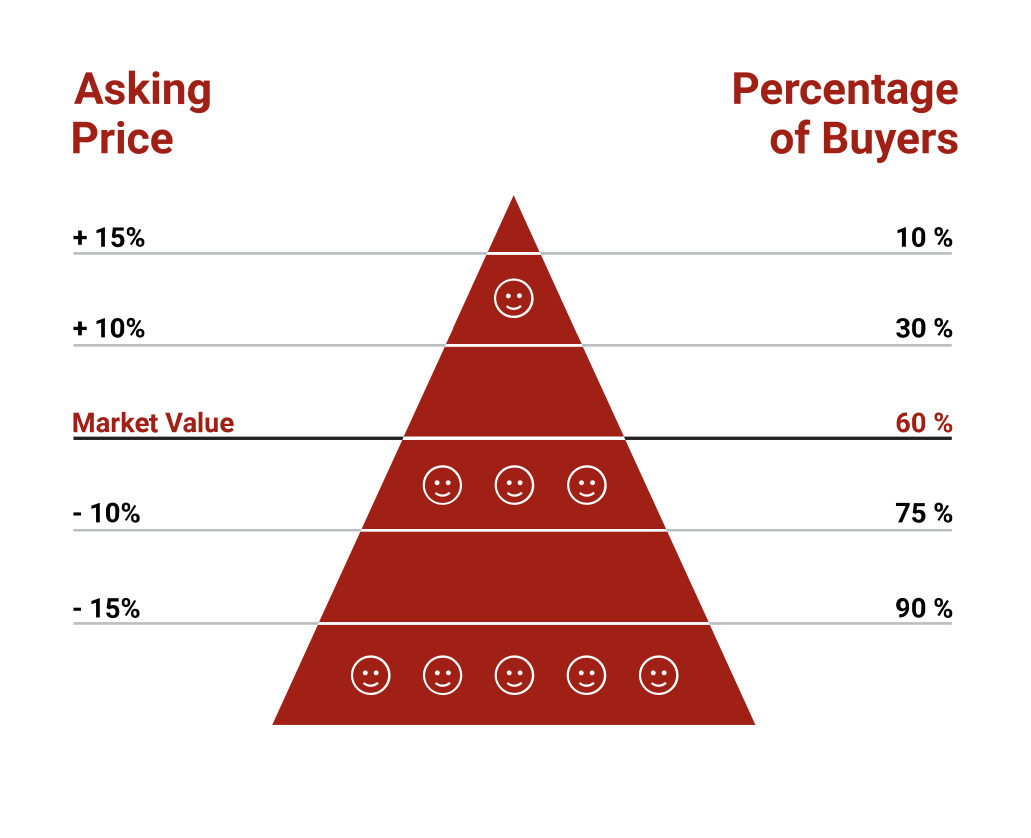

Price

the single most important element of a successful short sale strategy is the list price. Because short sales have stricter time limits, it is highly important that the home is priced right when it is listed for sale on the market. As your short sale Chicago real estate experts, we will create a Comparative Market Analysis (CMA) and pricing strategy based on the home’s current condition, most recent comparable home sales in your area and how much time you have left to sell your home before a foreclosure.

Proposal

a complete and cohesive short sale proposal must be presented to your mortgage lender to ensure that your short sale is approved by the bank. As your expert short sale realtors, we will ensure this process is painless and that your short sale is approved.

Follow Up and Communication

as your expert short sale real estate agent, we will know when to follow up with the bank to address any outstanding lender issues throughout each step in the short sale process.

Time

as your short sale experts in Chicago, we know the foreclosure laws in Illinois and we will be able to provide an estimated timeline for the closing of the sale once the sale is approved by the bank. Any mishaps during the short sale process could lead to weeks or months of delays.

Proper Protocol

it is vital that when we submit your short sale file for the bank to review, that all of the proper protocol is adhered to per the bank’s guidelines or else long delays may ensue.

Lowball Offer

it is important to note that a short sale is not a fire sale! In order to get your short sale approved by the bank, it is important to submit an offer from a qualified buyer that is more attractive to your bank than a foreclosure. This ties in to the original list price and why getting the pricing strategy correct the first time is so important when listing a short sale home on the market.

Buyer Approval

because a buyer makes an offer on your home does not mean that buyer is actually qualified to purchase the home. A homebuyer must be approved for financing and actually have verified funds available to close on the home. It is important not to risk this process because time is of the essence in real estate. As a short sale home seller, you are on a strict timeline and it will be important to work with an expert short sale real estate agent that knows how to communicate with the buyer’s agent and mortgage lender to make the most of your time.

Connect with Chicago Short Sale Experts Today!

Top Short Sale Realtors West Town Chicago

Michael Samm and Mark Quesada

312-767-7504

Work with trusted talent and contact an experienced short sale realtor for all of your Chicago home selling needs. Our #1 goal is to save you time and money during the short sale process.

Connect with an experienced short sale real estate agent in Chicago today!

The West Town Team | Short Sale Agents

312-767-7504

Read our client reviews on Zillow.

6 Things to Know about Short Sales as a Home Seller:

After the bank receives the short sale proposal, the bank may require at least 30-45 business days to approve the short sale. After short sale approval, the sale must close within a time frame approved by the bank, typically 30 calendar days.

The seller will receive no cash from this transaction. Any funds usually due to the seller will be paid to the bank.

The seller has no additional cash and will be unable to pay for any closing costs or provide a credit to the buyer for the appraisal or a home warranty. Should the buyer desire a home warranty they are free to purchase one at closing.

The seller may be unable to pay for maintaining the property. The property will remain in the current condition through closing; the seller will not be able to make any repairs to the property or credit the buyer for repairs. The home will be sold as-is or in the same condition as it was at the time of listing the home for sale.

The seller’s forgiven or cancelled debt may be taxable income. The seller should discuss this matter with a tax professional or accountant. This has no bearing whatsoever on the buyer.

In some cases the lender may pursue a deficiency judgment against the seller for any funds not collected at closing. This has no bearing whatsoever on the buyer.